2017 Crystal Ball

As we transition out of the Holidays and set our sights on 2017, it’s time to see what the economists are saying about this year’s housing market. Here’s a short summary of topics being discussed in the industry.

Increasing Interest Rates

Rates have increased from the record low of 3.375% all summer to 4.125% on December 1, with an increase of over 0.5% accounted for since the election. In fact, the 10-year Treasury bond rate increased from 1.8% to 2.1% the day after the election on expectations that Trump’s policies will increase budget deficits.

With the Federal Reserve hiking short-term interest rates by 0.25% in December and strong employment and economic reports as of late, it’s worth assuming this signals the increased rates are permanent. But Jonathan Smoke, chief economist at Realtor.com, points out buyer demand has not been dampened historically until rates reach 6.5-7%.

As far as local impact, another half a percentage point increase on a $750,000 home (with 20% down) only increases the monthly payment by about $200–hardly enough to change a Bainbridge buyer’s affordability.

Given the unbalanced dynamics in the market, I do not anticipate higher rates having an impact on the highly-qualified buyers that represent local demand for housing.

Continued Price Increases

While one national prediction is for a slowed 3.9% growth compared to the 4.9% of 2016, the Vice President of Statistical and Economic Modeling at VeroForecast, Eric Fox predicts the top forecast in the country to be Seattle at 11.2% because of our robust economy and subsequent growing population placing demand on the low supply of homes.

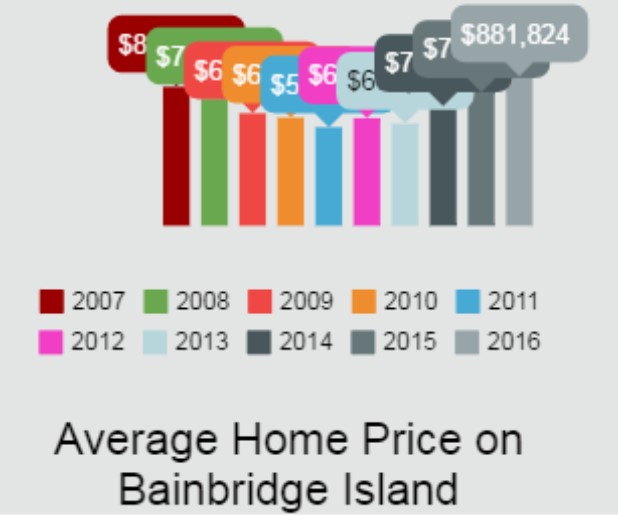

The average sale price on Bainbridge Island last year was a new record at $878,121, only the second time this number has surpassed $800K ($820,569 in 2007).

Double digit year over year growth of Bainbridge home values for several years in a row has done wonders for Seller’s net proceeds at closing, but it’s been hard to see Buyers pay prices that are at or above peak 2007 levels.

Even though I own property here, I would like to see our rate of growth slow bit, but it’s reasonable to assume we’ll see continued gains.

Baby Boomers Will Drive Markets

Many in our country’s second largest generation (yes, second to Millennials!) are the midst of a major life change, be it having a newly-empty nest or approaching retirement. With homes prices high and interest rates still near historically-low levels keeping qualified buyers in the market, it’s cliché but true–it’s a great time to sell.

In fact, 2015-16 were the best Seller’s Market in the Island’s history, as measured by average Months Supply of homes with 2.2 and 2.7, respectively: 6 Months Supply is considered a balanced market.

If the thought of downsizing seems a bit overwhelming, I hope some of my resources will help give some direction to the journey.

Stagnant Inventory Levels (Low Supply)

The 929 Active Listings on Bainbridge last year was the second-lowest on record, though it was 22.8% higher than record-low 2015.

Talk to anyone who wants to sell, and they will tell you about how much trouble they are having finding their next home. Many potential Sellers find themselves trapped in a home with few options for purchase because they think they need to rely on their net proceeds to help make the next purchase, thus causing massive gridlock in the market with no change in sight. However, there are options for Sellers to decouple the two transactions and potential deregulation in the mortgage industry may loosen lending requirements.

If you are looking to sell, you can expect to still be in the catbird seat as you are holding the limited supply in a region experiencing high demand. If you are looking to buy, you can expect to continue to compete against the other buyers as you all have demand for that limited supply.

More statistics and insight for Sellers can be found here.

Bainbridge Has Been Discovered (High Demand)

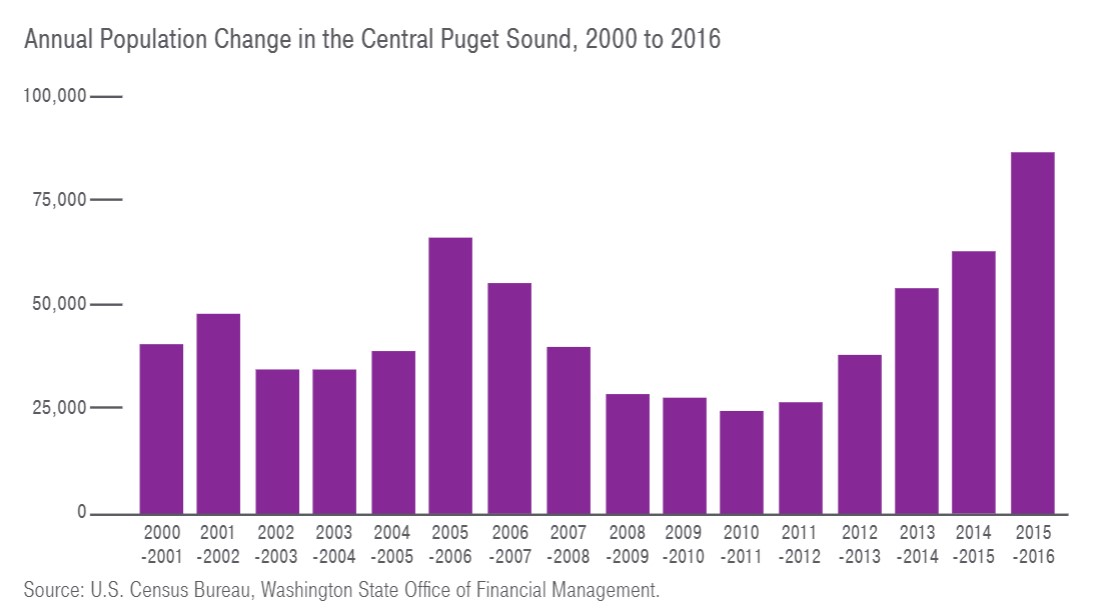

The trend in Puget Sound’s population growth is clear and shows no signs of slowing down. Between Nov. 2015 and Nov. 2016, the Construction industry increased its number of jobs by 9.2% and the Information industry (tech jobs) increased by 8.1%.

Given the high prices downtown ($969,832 average home sale price in Central Seattle in 2016), it makes sense for people to look across the water at Bainbridge rather than consider commuting another direction on land.

Uncertain Policy Changes

With a new captain at the helm of the American economy, there are a lot of questions about how the markets will react, how deregulation may impact the financial-services industry and how consumer confidence will shape decision making.

I will not be going on the record to predict how the big picture will unfold, but I am optimistic that we will not be going down with the ship.

Despite how you interpret all the above, there is good news for both buyers and sellers–strategically planning for the transaction ahead of time can set you up for success. Contact me to learn how at 206.399.3641 or jason@mrshutt.com.